BlackRock - Mega forces: An investment opportunity

Mega forces are big, structural changes that affect investing now - and far in the future.

Mega forces: As key drivers of the new regime of greater macroeconomic and market volatility, they change the long-term growth and inflation outlook and are poised to create big shifts in profitability across economies and sectors. This creates major opportunities - and risks - for investors.Here we outline the five mega forces we are tracking – and will share our research on each over time.

1. Demographic divergence

The world is split between aging and younger economies

Aging populations in major economies are poised to limit how much countries can produce and grow. By contrast, selected emerging market economies can benefit from younger populations and growing middle classes.

> Read our take on demographic divergence

2. Digital disruption and artificial intelligence (AI)

Potential to boost productivity

Artificial intelligence can automate laborious tasks, analyze huge sets of data and help generate fresh ideas. Digital disruption goes beyond AI.

3. Geopolitical fragmentation and economic competition

Rewiring global supply chains

In a marked departure from the post-Cold War period of increasing globalization, we see countries favoring national security and resilience over economic efficiency.

> Read more on geopolitical fragmentation

4. Future of finance

A fast-evolving financial architecture

A fast-evolving financial architecture is changing how households and companies use cash, borrow, transact and seek returns.

> Learn more on the future of finance

5. Transition to a low-carbon economy

A massive reallocation of capital

The transition to a low-carbon economy is set to spur a massive reallocation of capital as energy systems are rewired.

> Learn how we track the transition

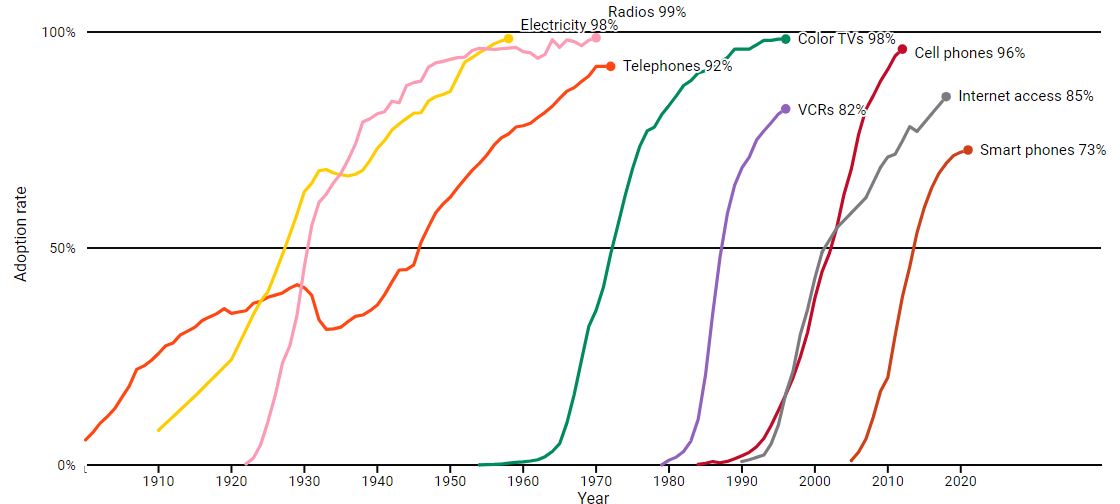

Adopting new technology

The key to harnessing mega forces and their potential is to first identify the catalysts that can supercharge them and how they interact with each other.

Rapid adoption of technology can change the path of transitions. Markets can underappreciate the speed of transitions, creating investment opportunities. Conversely, exuberance over their potential can also cause temporary price spikes. AI has been turbocharged by the roll-out of ChatGPT and other consumer-friendly tools. We think markets are still assessing the potential effects as AI applications could disrupt entire industries and bring greater cybersecurity risks across the board.

U.S. technology adoption, 1900-2021

Source: BlackRock Investment Institute, with data from Federal Communications Commission, U.S. Census Bureau, World Bank and Statista, 2021. Note: Adoption rates are based on household ownership except for cell phone and smart phones which are ownership per capita.

Important Information:

Capital at Risk

All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed.

Past performance is not a reliable indicator of current or future results. It is not possible to invest directly in an index. Sources: Blackrock Investment Institute, November 2022. Notes: The boxes in this stylized matrix show how our tactical views on broad assets classes would switch if we were to change our assessment of market risk sentiment or assessment of how much economic damage is priced in. The potential view changes are from a U.S. dollar perspective. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast or guarantee of future results. This information should not be relied upon as investment advice regarding any particular fund, strategy or security.