Fidelity International - The value trapped in our closets

Fidelity International - The value trapped in our closets

As the days start to get a little longer, our thoughts will naturally turn to spring cleaning and discarding unwanted clutter. But before you reach for the bin, there is a growing range of reuse options available. Portfolio managers Velislava Dimitrova and Cornelia Furse take a look at the companies offering solutions to monetise unwanted items and extend the lives of products, outlining the environmental benefits and investment opportunities this is creating.

Key Points

- Unwanted items are often discarded, but they can have value. The resale industry allows sellers to make money, buyers to cuts costs, and the overall carbon footprint to fall.

- The resale clothing market is growing more than 10 times faster than the broader retail sector and is forecast to become a US$77bn market by 2025.

- Today’s successful resale platforms are sophisticated technology companies, with data likely to become an increasingly valuable asset in its own right over time.

Many of us have received unwanted gifts or have things that we no longer need taking up space in our homes. These surplus items are often discarded as rubbish, but they can have value, which can be monetised. A growing number of businesses are popping up that facilitate the reuse of items, extending product lives and helping the environment in the process. This resale industry has both financial and environmental benefits by allowing sellers to make money, buyers to cuts costs, and the overall carbon footprint to fall.

For example, the clothing industry is a prime candidate for increasing its resale activity and cutting its environmental impact. In 2018, the fashion industry contributed 4% of global greenhouse gases according to McKinsey. This was equivalent to the UK, France and Germany combined.

Used clothing is substantially more environmentally friendly than new items and reduce the carbon footprint of new clothing by 82%. The US Environmental Protection Agency (EPA) estimates that 95% of the 36 billion clothing items thrown away each year in the US could be recycled or reused. If we are to achieve the 2050 1.5c climate change target, the clothing sector needs to become more circular.

The birth of online marketplaces

Before eBay and not including auction houses, which cater for big ticket goods, classified ads were the best solution we had as a mass marketplace for resale items. Their function was simple: to enable people to monetise unwanted goods by connecting them with bargain hunters. But the process was clunky, time consuming and inconsistent. The transaction could fail for any number of reasons and even if it did complete, either party could end up dissatisfied.

With the advent of the internet, eBay was launched as an online marketplace that smoothed many of the bumps in the second-hand market. The pool of buyers and sellers was much bigger boosting the chances of successful transactions, the auction process facilitated price discovery, detailed descriptions and product images helped match expectations, and the payment function reduced fraud and built trust.

Specialised second-hand marketplaces

In recent years, a plethora of marketplaces for second-hand items have been established that serve specific consumer needs and make the transaction process increasingly efficient. Resale items include clothing, jewellery, accessories, and luxury goods.

Mercari is an online marketplace with a presence in Japan and the US. It sells anything from decorative toilet paper holders to iPhones and completes over JPY 10bn in transactions each month. Its slick app makes it easy to buy and sell items, it has a fixed fee that’s only charged if a sale is made, and its agreements with logistics providers allow sellers to ship anonymously from local convenience stores. While Mercari’s platform overlaps with eBay’s, Mercari’s ease of use is very effective in attracting and retaining beginner buyers and sellers.

Depop is a more specialised and socially led platform. Buyers and sellers trade mostly vintage, used or repurposed apparel, and users list, price and ship items for a flat fee. What Depop excels at is blurring the distinction between social media and e-commerce, and the platform feels more akin to Instagram than a marketplace, engaging millions of users, almost all of them under the age of 26. This demographic (Generation Z and Millennials) are crucial as they will drive future consumption trends. Therefore, it’s not surprising that Depop was bought by craft-based platform Etsy for US$1.6bn in June 2021.

Younger generations driving the resale sector

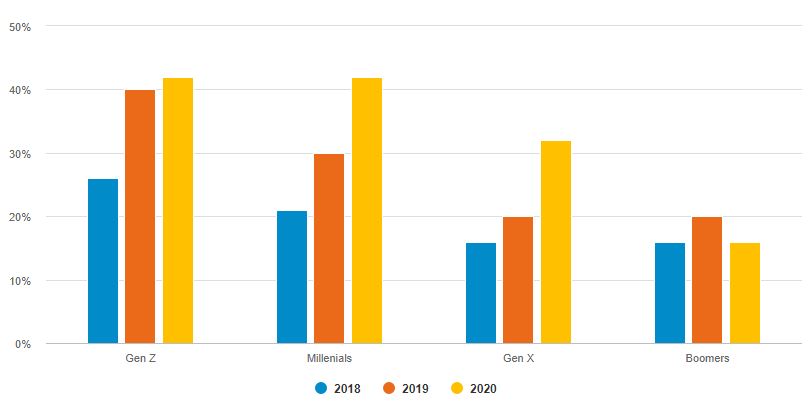

Consumers shopping second-hand apparel

Source: Global Data Consumer Survey, April 2021.

Gen Z and some Millennials are the first generations to be born into the online world. They are tech savvy and sophisticated retail customers. They know the brands they want and the latest styles. They are climate aware and have different attitudes to resale and reuse than older cohorts. Gen Z are 83% more likely than boomers to think of apparel ownership as temporary and 33% more likely to have resold clothing according to Global Data’s Consumer Survey, April 2021. They are also 165% more likely to consider the resale value of clothing before buying them, indicating a trading mentality to clothing purchases.

The influence of Gen Z and Millennials will contribute to the expansion of the resale clothing market, which is forecast to grow over 10 times faster than the broader retail sector to become a US$77bn market by 2025, dwarfing the US$40bn expected size of the fast fashion industry.

Reducing market frictions

If Depop and Mercari are marketplaces, The RealReal and ThredUP are exchanges. Just as securities exchanges evolved from the original coffee house marketplaces to act as counterparties between buyers and sellers of financial instruments, exchanges for second-hand items have appeared. Their function is similar to securities exchanges - to increase market liquidity. By stepping in between the buyer and seller, they build trust, standardise the consumer experience and smooth away frictions.

The RealReal is an intermediary in luxury and high-end goods. You can send items to the company or they will collect from you, then they will list, price, package and deliver to the end buyer. As the agent, the RealReal charge a variable commission depending on the item.

ThredUP follows a similar model but targeted at more mass market goods. It plays an important role in authenticating and quality controlling products. Both the RealReal and ThredUP are adopting clever marketing techniques to reach wider audiences. The RealReal has teamed up with members of the Kardashian influencer family to sell hundreds of luxury pieces. ThredUP has a partnership with the popular TV show Sex and the City to replicate iconic looks from the programme at a lower price point. Both companies have a market cap of over US$1bn.

Resale technology offsetting climate change

The use of technology has been a key enabler of the success of these platforms. These resale platforms are sophisticated technology companies, with constantly developing algorithms improving the user experience. They also collect data, gathering real-time insights about what items sell, to whom, and what trends have longevity. This data will become an increasingly valuable asset in its own right over time.

We have a positive trend underway where technology solutions and the ease of use of resale platforms is improving, in turn encouraging more consumers onto the platforms. This is welcome news for consumer buyers and sellers, and the environment, helping the world unlock the value trapped in their closets.

Important Information:

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in emerging markets can be more volatile than in other more developed markets. Fidelity’s range of equity funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. A focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes.