Robeco - Have your cake and eat it, too: Finding alpha in sustainability

Asset owners and their stakeholders increasingly expect to achieve their financial goals while ensuring positive non-financial results for future generations as well. The key question is whether it’s possible to do both. We develop and explore a process that explicitly focuses on both dimensions instead of treating them as separate goals that must be traded off against each other.

The social responsibility of business is to increase its profits

Milton Friedman's famous doctrine is often interpreted as an argument against combining alpha and sustainability. After all, a company that diverts its profits to support social causes is unfairly straying from its core purpose: to make money for the shareholders.

Yet in this increasingly intangible economy, sustainability is a key component of financial success. While in the 1970s, companies' values were predominantly tied to physical assets, now the largest companies in the S&P 500 often derive much of their value from intangible assets such as intellectual property, brand value, and network effects. Sustainability provides a powerful lens through which to analyze such assets.

The linkage between sustainability-related considerations and corporate valuation is termed ‘financial materiality’. When financially material, sustainability considerations may actually increase a company’s valuation and/or increase its profitability while at the same time making the company more socially responsible, aligning with Friedman’s doctrine after all.

Library of SI alpha signals

Thanks to the improvement of sustainability data and the increasing availability of advanced algorithms to extract and analyze these data, we’ve developed a library of signals that contribute to our portfolios’ sustainability and expected alpha. Both these elements must be incorporated throughout the entire research and development process; approaches that consider sustainability as an afterthought or compromise it for the sole goal of alpha generation are likely to fall short.

A sound economic rationale is therefore necessary to underpin each investment hypothesis. Below we discuss two signals and their accompanying rationales: resource efficiency and employee satisfaction.

Resource efficiency

Economic activity inevitably produces CO2 emissions, which are tied to inputs used in the production process. Consequently, emissions relative to economic output can serve as a proxy for operational efficiency. This is especially relevant for resource-intensive sectors, where emissions are closely tied to the production process. Our quantitative researchers incorporate these insights into our signal creation, supported by our fundamental research teams.

The resource efficiency framework suggests that a company generating more economic output than its competitors – given the same input – employs a more efficient process. Thus, lower emissions can indicate higher operational efficiency.

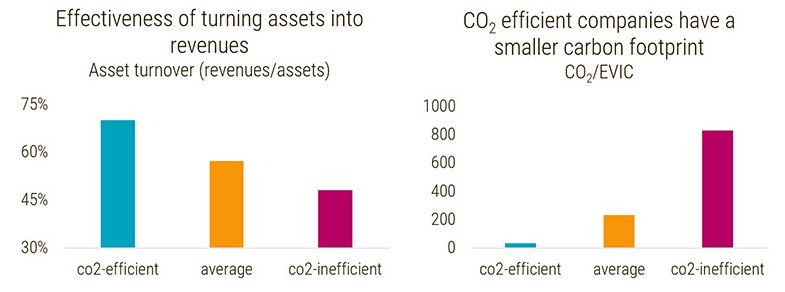

A study by Robeco found that more resource-efficient companies also score higher on more traditional operational efficiency measures, such as asset turnover, which suggests better financial performance and higher alpha than their less efficient counterparts. Likewise, overweighting resource-efficient firms also reduces a portfolio’s overall environmental footprint.

Both are illustrated in Figure 1. This supports the idea that a well-constructed SI alpha signal must aim at both sustainability and return from research inception.

Figure 1 - Resource-efficient companies also more operationally efficient

Source: Robeco Quantitative Research. Asset turnover for CO2 efficient and CO2 inefficient companies; CO2 efficient and CO2 inefficient companies are defined by the top and bottom quintiles of sorting stocks based on CO2 efficiency. Averages for 2010-2022 are shown. EVIC stands for enterprise value including cash.

Happy employees

Employee satisfaction is another factor impacting both a portfolio’s sustainability profile and expected alpha. As previously noted, a company’s value often hinges on intangible assets, particularly human capital. Despite the growth of artificial intelligence, companies remain reliant on their human workforce. However, quantifying this asset is challenging since it's not directly reflected in financial statements.

The premise behind this alpha signal is that a satisfied workforce is likely more motivated and efficient, leading to better operational and, eventually, financial performance. Employee satisfaction, influenced by factors ranging from healthy canteen food to a culture fostering innovation, also aligns with corporate social responsibility goals.

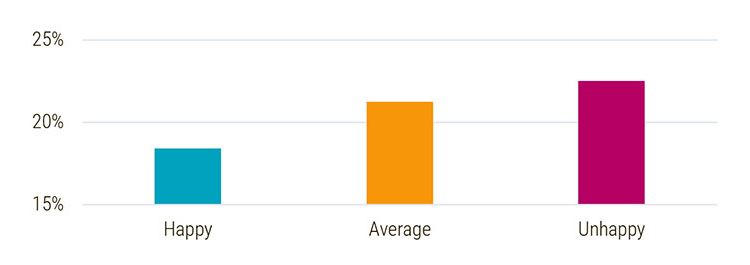

A palpable indicator of the impact of workforce satisfaction on efficiency is payroll expenses. As Figure 2 illustrates, companies with happier workforces spend less on payroll per unit of revenue than those with unsatisfied employees, suggesting that overweighting companies with high employee satisfaction can generate positive alpha.

Assessing employee satisfaction and corporate culture involves various methods, from numerical ratings to reviews and testimonials, often requiring advanced analytics like natural language processing (NLP) to extract information from unstructured data. Venturing beyond readily available datasets offers deeper insights into a company's human capital.

Figure 2 - Payroll expenses as percentage of sales

Source: Robeco Quantitative Research. Employee happiness is based on a proprietary signal from crowd-sourced employee reviews. Over the period 2013-2021.

As discussed in this note, it is possible to deliver both better portfolio sustainability characteristics and expected alpha, under the financial materiality condition. Crucially, sustainability and alpha considerations must both lie at the core of any SI alpha signal. The additional benefit of using the quantitative approach to sustainable investing is the comprehensive toolbox comprising statistical and analytical techniques that allows for quantifying alpha and sustainability-related enhancements.

Robeco, being both a quant pioneer and a sustainability leader, has developed a library of SI alpha factors that do both. Enhancing returns, stripping out unrewarded risks, and pushing the sustainable frontier are integral to our philosophy and research process. We are happy to share our findings with our clients and other stakeholders and look forward to finding new ways to achieve their financial and sustainability goals.

Important Information:

The content of this marketing document is based upon sources of information believed to be reliable and comes without warranties of any kind. Without further explanation this document cannot be considered complete. Any opinions, estimates or forecasts may be changed at any time without prior warning. If in doubt, please seek independent advice. It is intended to provide the professional investor with general information on Robeco’s specific capabilities, but has not been prepared by Robeco as investment research and does not constitute an investment recommendation or advice to buy or sell certain securities or investment products and/or to adopt any investment strategy and/or legal, accounting or tax advice. Before investing, please note the initial capital is not guaranteed. Investors should ensure that they fully understand the risk associated with any Robeco product or service offered in their country of domicile. Investors should also consider their own investment objective and risk tolerance level. Historical returns are provided for illustrative purposes only. The price of units may go down as well as up and the past performance is not indicative of future performance.